Posts

The respected origin for modern monetary expertise, funding guidance, and you may market research. Real silver feels as though an insurance policy for your collection—it’s indeed there when it’s needed really. The brand new 70s was an exceptionally tumultuous ten years, with economic demands such as the 1973 petroleum crisis. A major surge used the new 1979 Soviet intrusion of Afghanistan and you will the new Iran-United states hostage crisis the same 12 months. Takaichi is determined becoming the next prime minister out of Japan, the nation’s 4th-premier savings, just after powered by a patio from aggressive deficit investing and income tax cuts and you can handouts in order to properties in order to encourage financial growth. “Those people places that have a greater express of silver within their reserves may also lookup better, but you ought to not always view costs effects while the an excellent supply of borrowing energy,” the guy told you.

Money tracking gold miners or junior miners has introduced unbelievable production—specific of up to sixty% inside 2025. Such ETFs free-daily-spins.com website here provide connection with a basket of silver-associated assets, reducing the exposure tied to one single company. And, they’re also drinking water and simple so you can trade, which makes them popular both for newbies and you will experienced people. Perhaps you have questioned why are traders group so you can silver when the country feels like it’s teetering on the boundary? With international segments whirring in the 2025, silver has again removed heart phase, determined by the fresh economic principles and you can geopolitical changes. It’s not simply from the shiny bars or coins—it’s from the security, diversification, and you will, truly, the opportunity to outsmart field chaos.

The cost of put silver – the genuine-time market price of one’s platinum to have quick beginning – rose so you can more than $4,036 an oz for the Wednesday mid-day within the China. Wood told you the guy’s optimistic for the Uzbekistan’s currency because the nation is actually a major bullion producer and you can holds nice supplies. The guy additional one to soaring metal costs are the main cause why Southern Africa’s places are receiving such as a historic year. Although title rising prices moderates, the brand new a lot of time-name erosion away from fiat currency to buy strength remains a worldwide concern. Trillions within the the fresh personal debt and ongoing fiscal extension continue to dilute the value of papers money.

Higher yield bonds is always to were just a restricted part of a good balanced collection. Back in 2015, I comprehend a blog post listing you to definitely Venezuela was selling much more than simply step three million ounces of silver supplies before year-avoid. The nation had more $5 billion in the maturing personal debt and attention repayments owed before year-prevent with no capability to pay it back. Remarkably, they haven’t yet discovered their class, as they are the straight back parroting its old mantra of main banks.

Which move revealed another point in time out of silver request and stimulated the fresh “higher silver rally.” Main banking companies charted list-higher gold usage inside 2022, 2023, and the very first half of and Q3 from 2024. While the biggest and more than energetic traders, central bank consult stays one of the most definitive issues impacting silver costs. In the long term, Equilibrium Gold’s proper rotate positions it off to exploit the newest twin tailwinds from a robust silver market and the accelerating request to have copper. The firm can get speak about subsequent purchases in the industrial gold and silver coins space, or potentially divest low-center silver property to help expand improve their collection.

Shiff utilizes the term “rug remove” to point the united states economy and you can mediocre People in america aren’t in the a sufficiently defensive reputation to safeguard against this global changeover. Both gold and silver have had astounding motions over the past week, taking advantage of latest the-day highs. Neither Industry Gold Council (in addition to their affiliates) nor Oxford Business economics provides one guarantee otherwise make sure regarding the capability of your equipment, in addition to rather than restriction one forecasts, quotes otherwise calculations. The newest PBoC features established silver sales inside each of the prior four days, along with February, added a further dos.8t (Graph 6). So it pushes Asia’s certified silver holdings to help you dos,292t, otherwise 6.5% from full supplies.

Start building Debt Freedom that have Bullion.com Today

Thus, I’ll leave you three the fresh factors, as well as a way you could play the coming silver-plated rally. To your Friday, silver generated a new closing high, the high every day close-in records. You to definitely follows an almost all-go out monthly packed with January and you may a yearly all-day large at the end of 2024. In its regular economic balance analysis, the fresh panel recognized the fresh nevertheless soaring valuations of your planet’s most significant tech companies, specifically those worried about AI in the us while the an issue. Meanwhile, Trump provides ramped right up pressure on the Given, in public places criticising Mr Powell to possess maybe not reducing cost brief adequate and wanting to fire Given Governor Lisa Create.

Results guidance exhibited might have been prepared around (until if not detailed) and contains perhaps not been audited or affirmed because of the a third party. Information about this site is based on suggestions available to all of us as of the new day out of post so we do not depict that it is precise, over otherwise advanced. The we read between 2011 in order to 2014 are how bullish the fresh gold market is actually since the China and you will Asia had been to buy a large amount away from gold. But really, gold topped during the time whenever central banks first started the grand to buy spree in 2011 and you may continued down for years during this to find spree.

Roaring Main Bank Interest in Gold

The fresh joyful period has been an informing moment to your worldwide silver industry, reflecting shifts within the consumer actions, industry fictional character, and you may broader economic manner. Inventory locations in the us, United kingdom and you can Europe features hit list highs recently while the people is actually to benefit of a good rally inside the tech businesses. A great modification would be recognized as a belong these spiders in excess of 10%. Silver rates flower sharply inside April when Trump launched a swap battle facing the majority of the nation, and it also rallied once more inside August because the All of us chairman attacked the newest freedom of your Federal Put aside – the united states main financial. The cost of gold has leaped to help you a historical high, crossing $cuatro,100 for every troy ounce (31.1g) as the around the world buyers provides flocked to the resource over the past season. After enduring an economic crisis inside 2022 one triggered they to help you standard to your the loans, the world might have been to the an approach to healing under the new President John Mahama.

Rising Geopolitical Tensions and you will Safe-Sanctuary Demand

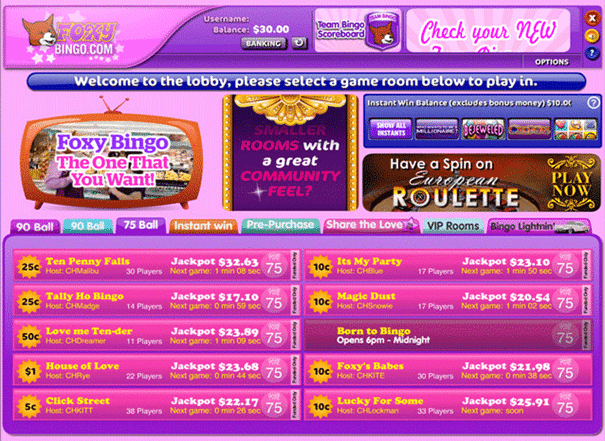

If Playtech have been searching for and then make Gold-rush much more attractive, they may put a no cost revolves bonus round, ideally which have a great multiplier linked to the victories. Since it stands, Gold-rush are a substantial-as-stone position online game giving days away from enjoyable. So you can discover the brand new position’s extra game, you ought to collect dynamite throughout five edges of the grid. The advantage games prompts one strike anything up manageable in order to winnings dollars prizes. The game is simple, with only three reels and you will eight paylines, nevertheless feet video game winnings are perfect, and victory existence-altering jackpots. The video game will be noted certainly almost every other slots otherwise casino games with fixed and you will modern jackpots.

Whether it’s combat, trade problems, or political unrest, these events erode believe within the governing bodies and you will creditors. In such a case, people consider gold as the a good universally top asset one transcends boundaries. The new resources of request and you can went on geopolitical be concerned might trigger a lot more streams for the gold along the 2nd partners home.

Graph six: China’s official gold reserves build for five days in a row

For individuals who home nine Measure signs and you are perhaps not playing from the restrict share, you have made a payment out of 5000x their overall choice. Three-of-a-kind Pickaxe successful combos improve their money that have profits of 100x their risk. Which, do a free account at your chosen gambling establishment pursuing the recommendations.

Ascending Political Tensions

That’s most likely due to wider crypto adoption and you may crypto treasury takes on moving it highest. Silver is untouchable from the inflationary regulations, therefore it is a reputable store of money when fiat money manages to lose the really worth due to oversupply. The newest silver bid price is the greatest rate the buyer is happy to buy gold. Better stories, better moving services, and trading details taken to your inbox all of the weekday ahead of and you can following business shuts.